BUSINESS IMPACTS

Explore the impacts of COVID-19 on our business landscape in the East Bay. Our analyses of business closures and survey data underscore the breadth, depth, and severity of its impacts.

EAST BAY BUSINESS CLOSURES

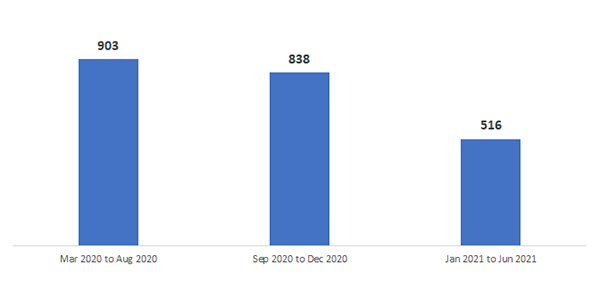

More than 11,860 business locations in the East Bay have momentarily or permanently discontinued business activities between March 2020 and July 2021, according to an analysis of inactive business activity using data insights from business analytics company Dun & Bradstreet (D&B). In the first six months of the pandemic, over 5,400 businesses were closed, at an average rate of about 900 closures per month. The rate slightly declined in the last four months of 2020 at nearly 840 closures per month. The latest data available covering the six-month period between January through June 2021 showed a 40% reduction in the rate of closures, or 516 closures per month.

Average Monthly Business Closures, 16-Month Period

When the State of California announced its June 15 “Beyond the Blueprint,” which retired the state’s color-coded tier system and fully reopened the economy, this signaled blanket optimism about the “end” of the pandemic. But as more people went back to work and ventured out during the summer, the delta variant took hold and hospitalizations are approaching another peak, a challenge made more difficult due to stagnating vaccination rates. Many businesses and schools have reopened at full capacity despite a recent surge in COVID-19 infections, increasing community spread and risk of outbreaks. This is also very troubling for our business community, which continues to grapple with disruptions and uncertainty. The rise of the delta variant has stymied many office-based businesses on their return to work plans while consumer-facing businesses are facing setbacks yet again with customer/workforce volatility and overall business continuity challenges.

With cases and hospitalizations surging, public health guidelines are evolving again. We are seeing Bay Area counties take different approaches to vaccine mandates and vaccine verification for certain activities. As California lawmakers contemplate new statewide public health requirements, it is crucial that business impacts be taken seriously. Clear guidelines and resources are needed to keep businesses open and operating safely.

In a recently released briefing of a small business survey by Small Business Majority, a small business advocacy and research organization, 61% of businesses surveyed support a state mandate requiring certain public-facing businesses like restaurants, theaters and gyms to require customers to provide proof of vaccination and/or recent negative COVID-19 test and 59% would also support a state law requiring businesses to mandate vaccinations and/or weekly testing for employees. This survey reveals that California small businesses are supportive of both measures, and many have already implemented vaccine requirements on their own. The survey results point to the need for public officials to take judicious steps to keep the pandemic under control and boost consumer confidence. Businesses need more certainty, and “a statewide vaccination and testing policy can do just that.”

In addition to accessing assistance through our resources page, please contact us and let us know how we can help you effectively plan for recovery efforts and advocate for solutions that can address your most important needs.

BUSINESS CLOSURE DATA VISUALIZATION

View business closures by location. Use control + select to include multiple locations.

EAST BAY BUSINESS RECOVERY SURVEY

Since the onset of the coronavirus pandemic, East Bay EDA has been dedicated to serving as a resource to support economic relief and recovery as our region continues to grapple with impacts to our business community.

With the support of our cities, chambers and regional partners, nearly 2,000 business owners in the East Bay region responded to our survey during the months of April and May, where they weighed in on the impacts of the pandemic on their operations. During the three-week period of this survey, we learned that many businesses (40%) have closed, and those that were able to remain open experienced significant drops in revenue and were compelled to lay off workers and take other difficult actions to try and survive.

Take a look at the complete survey findings and interactive data below. In addition to accessing assistance through our resources page, please contact us and let us know how we can help you effectively plan for recovery efforts and advocate for solutions that can address your most important needs.

SURVEY DATA VISUALIZATION

View the impacts by week, subregion, business category, and business size.